Relentlessly agile and direct.

Team

A multi-generational team of builders and creative problem solvers

The team

CAPAC’s team is composed of a multi-generational group of creative problem-solvers. The team consists of successful founders with experience in technology, finance, and banking, as well as engineers, scientists, investors, and artists. The team is agile, direct and committed to building long-term partnerships with investors and portfolio companies. The team aims to identify and capitalize on emerging trends and opportunities to drive growth and make a positive impact for future generations.

"Pulvinar varius velit blandit etiam massa posuere mauris scelerisque ornare nunc sed."

Lorem fistrum

General Manager

Team

ROLANDO RABINES, CFA

Managing Director

Rolando has over 35 years of successful experience as an entrepreneur and investor in a range of industries… Learn More

GONZALO PRESA, CFA

Managing Director

Gonzalo has over 22 years experience in financial markets. Formerly head of Private Banking for Scotiabank and… Learn More

ROBERTO VON WALD RABINES

Principal

Relocated to Singapore in 2022 to lead the expansion of a US Accelerator model to the ASEAN region.

Learn more

IACOPO PIERINELLI

Analyst

Currently he works as analyst at QAI, an Alternative Investment private boutique, specialized in private loans and private equity. Learn More

CHIARA PIERINELLI, MD, MSc

Venture Partner

Entrepreneur with successful companies in healthcare, wellness and digital education. Learn more

Rolando has over 35 years of successful experience as an entrepreneur and investor in a range of industries.

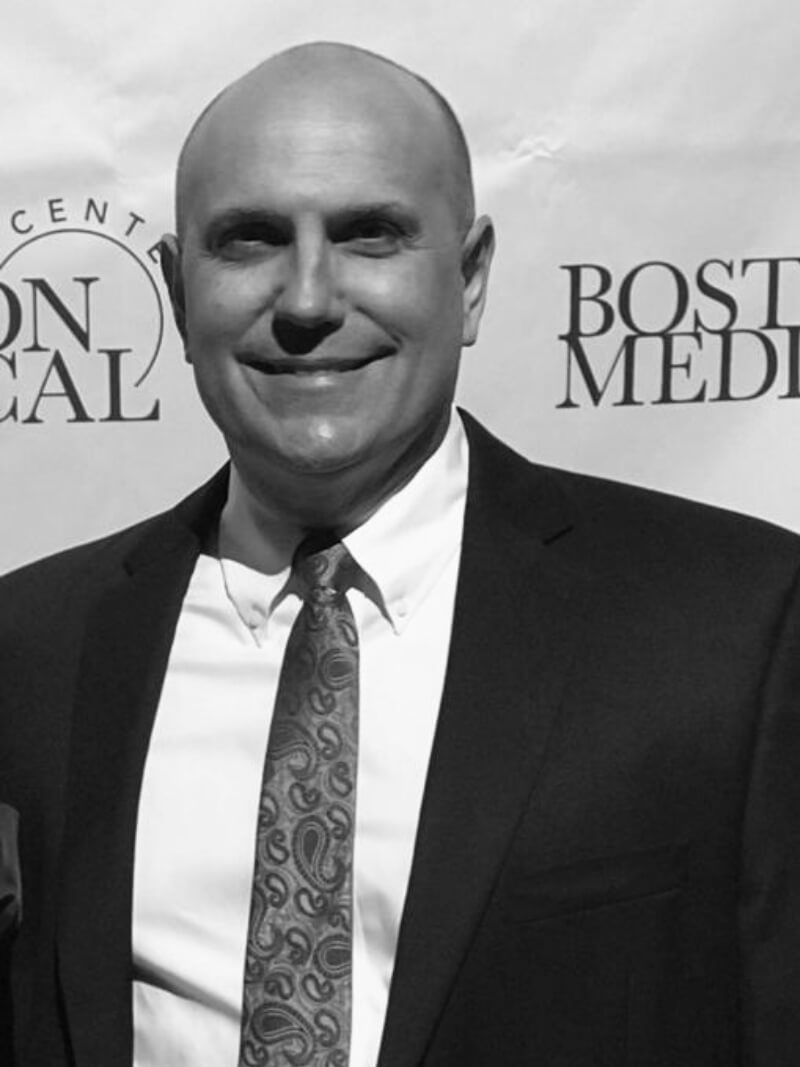

ROLANDO RABINES, CFA

Managing Director

Rolando makes lead private equity and venture investments through CAPAC and affiliated funds. His portfolio companies are currently developing opportunities in digital marketing networks, hospitality, Fintech, Healthtech and semiconductor technology.

Rolando holds a BSCS and a BSEE from MIT. He completed his graduation thesis on mobile robots under Dr. Rodney Brooks (iRobot Founder). He is a Chartered Financial Analyst and member of the Boston Securities Analyst Society. Rolando holds multiple patents relating to AI systems and distributed application components.

Rolando was investor and Executive Director at Atomera (ticker: ATOM) a semiconductor materials and intellectual property licensing company. Atomera developed Mears Silicon Technology (“MST”), which increases performance and power efficiency in semiconductor transistors. Rolando co-led the company from 2009 until 2016 IPO with current Chairman John Gerber. He hired a new management team, set up a commercialization advisory board, helped raise an additional $15M pre-IPO, and authored major portions of IPO S1. Atomera was added to the Russell 2000 index in 2020.

Prior to Atomera, Rolando was Co-Founder and CTO of Macgregor, a leading provider of trade order management systems to the buy-side community. Macgregor software served as a mission critical central hub for trading for 110 blue-chip institutional clientswith about $5.5 trillion in assets, including State Street Global, Merril Lynch, Invesco, and T. Rowe Price. Macgregor technology covered the complete continuum from portfolio creation to setting up all the compliance rules and delivering the trades to execution and compiling all the execution reports at the end of the day. Rolando also created the Macgregor Financial Network (MFN), which reached 280 brokers as well as electronic communications networks (ECNs) and alternative trading systems (ATSs). Macgregor was acquired by Investment Technology Group (ITG) for over $230 million in cash. Rolando personally developed the core technology and as CTO led a team of over 130 product management and developers through multiple technology generations and integration with acquisitions.

After graduating from MIT, Rolando joined BBN Systems and Technologies, Inc. He was the Systems Architect for SIMNET, an advanced research project sponsored by the Defense Advanced Research Projects Agency DARPA. SIMNET developed technology to build large-scale networks of interactive combat simulators. SIMNET revolutionized simulation–based training through breakthrough innovations in networking, computer graphics and AI. Rolando was responsible for designing and developing a military grade version of the technology using Ada that was deployed to the German army. Rolando was also an engineer at BBN’s Internet Gateway Group. BBN developed and supported the DARPA Internet system which consisted of a number of gateways and networks that collectively provide packet transport for hosts subscribing to the DARPA Internet protocol architecture (the precursor to the modern Internet). Rolando helped design and implement load sharing and security enhancements to the gateway node technology that connected the MILNET to the ARPANET.

Rolando worked at Motorola’s Portable Products Division where he helped design and develop industry leading secure communication radios for law enforcement, military and intelligence applications. He also worked at the MIT AI and Computer Science Laboratory Dataflow Processor project.

GONZALO PRESA, CFA

Managing Director

Gonzalo is an experienced portfolio manager with deep expertise in financial analysis. Throughout his more than 20-year career in the investment management industry, he is recognized for consistently achieving superior returns compared to his peers, as well as his leadership, ability, and creativity in implementing transformative and disruptive changes in the businesses and industries he has worked in.

He studied Economics at the Universidad del Pacifico and obtained an MBA from the Universidad de Piura, excelling academically in both cases. In 2006, he earned the CFA certification, being one of the first Peruvians to obtain this title and, for a time, the youngest in his country. Gonzalo maintains a close relationship with the academic world as he actively teaches at various institutes and universities in the country.

He began his professional career at the largest Pension Funds in Perú (ING and later BBVA), starting as an analyst and eventually becoming a Chief Investment Officer. Each of the pension funds he managed consistently ranked first in returns within the private pension system. During this time, he worked diligently with the regulator (SBS) to promote an increase in the limit for international investments, which rose from 5% to 35%, significantly improving the risk/return trade off of the funds and hence, the sustainability of the pension system.

Then he worked for the Scotiabank Group in Peru, first as CEO of Scotia Fondos and later as Head of Private Banking. At Scotia Fondos, he was able to double the assets under management (AUM) by completely changing the business strategy, focusing on the development of innovative products and exclusive distribution channels for corporate and affluent clients. During this time, he was the founder and President of the Mutual Fund Managers Association of Peru, a position in which he closely coordinated with the regulator (SMV) to implement a series of changes that allowed for further development of the mutual fund industry and the capital market in his country. As Head of Private Banking, he implemented a transformational change in the business model, shifting from a VIP transactional banking approach to a Wealth Management model with a focus on investment advisory, resulting in tripling the AUMs.

After a long and successful career in the corporate world, he founded his own advisory firm where he provides financial consulting services to high-net-worth individuals and families.

Gonzalo is also a talented visual artist. He has participated in various solo and group exhibitions. While art and business may not seem to have much in common, the ability to take a creative and disruptive idea and turn it into reality is what fuels his passion in both practices.

Precisely, CAPAC is the space where Gonzalo can harness his creativity and direct it towards creating value. It is a flexible environment without bureaucratic barriers or suffocating corporate structures, where he and his team can turn ambitious, challenging, and innovative visions into tangible realities.”

ROBERTO RABINES

Principal

Roberto is responsible for sourcing CAPAC technology deals in the Asia Pacific region. Leveraging his technical background, he is focused on helping portfolio companies drive growth through strategy, capital allocation, business development, and technology transformation. He specializes in frontier markets and also leads digital asset investments.

Roberto excels at helping management turn ideas into reality. He attended boarding school at Phillips Academy and entered the University of Chicago already experienced in software projects from the age of 14. While pursuing his undergraduate degree he worked at the Polsky Center developing and maintaining proprietary Innovation Fund datasets and visualizations to help directors better understand the venture funnel from promising research to successful exit. During college he began working on a novel idea for applying AI technologies including GPT-3 to generate real-time sports media articles and content. The project earned seed funding from an MIT alumni Family Office, and he took leave to work full time on the venture. Roberto was recruited by the same family office to help their startup accelerator attract new projects, becoming a full-time Entrepreneur in Residence.

Continuing his work with a network of MIT alumni family offices, he gained support for a new venture to expand the US investment model to the Asia Pacific region. He relocated to Singapore in 2022 to establish a local entity, navigating international incorporation and tax structure with lawyers and regulatory bodies. In addition to direct investment into early-stage companies and venture funds, he led a majority investment into regional software company AppsPOS Pte. Ltd.

While traveling between Singapore and Boston between 2024-2025, he earned his MBA from the MIT Sloan School of Management.

IACOPO PIERINELLI

Analyst

Iacopo is a skilled quantitative analyst. He has direct experience modeling and optimizing businesses in a broad range of consumer industries. He holds a degree in Industrial Engineering from Universidad de Lima. Iacopo has completed specialized training in sustainable business management and operations.

Prior to joining CAPAC, Iacopo worked as an investment analyst and Investment Committee member at SAMI, a Latam mid-market business credit company. SAMI invests across the credit spectrum and in credit-related strategies, including leveraged loans, high-yield bonds, structured products, private middle market loans, bespoke capital solutions, distressed securities and assets, non-performing loans, hard assets, and equities. At SAMI, he evaluated new deals and supported risk management.

Before SAMI, Iacopo worked at Growing Well Partners, a family office. As equity research associate, he helped value stocks using various methodologies, conduct primary industry research using the supply-chain approach, and develop investment theses on stocks by piecing together multiple data points. At Growing Well Partners Iacopo focused on the media and entertainment sector.

After graduating from Universidad de Lima, Iacopo worked as marketing analyst at multiple beverage companies including PepsiCo. In this role he developed, implemented, and optimized core marketing measurement frameworks and models, including attribution, churn, CLV, return on investment, experiment methodology, and segmentation.

As a CAPAC Quantitative Analyst, Iacopo works to develop investment ideas using fundamental and quantitative analysis. In this role he uses fundamentally driven models to assess company quality, valuation, and growth characteristics, while applying qualitative fundamentally driven reviews to capture additional insights. Iacopo also performs risk & return analysis to understand drivers of results and find opportunities to improve risk-adjusted returns across multiple strategies. He designs analytical tools for managing portfolio risk exposures, evaluates liquidity risks and performs scenario analysis. He is skilled in building multi-year financial models to determine appropriate valuations under various scenarios. Iacopo is currently focused on consumer finance companies.

Iacopo is an avid MTB athlete. He is fluent in Spanish, English and proficient in Italian.

CHIARA PIERINELLI MD, MSc

Venture Partner

Chiara is a successful physician, researcher, wellness entrepreneur, and investor. Her direct experience across a broad range of health ecosystems informs a unique perspective for identifying and developing ventures across the globe. Whether she is performing surgeries in the middle of the Moyobamba jungle, doing stem cell research at George Washington University, or working with portfolio companies to unlock new opportunities, Chiara always brings critical thinking and analysis skills that leverage deep scientific knowledge with new information to assemble the right diagnosis and path forward.

She graduated with honors from Universidad de San Martín de Porres in Lima after an Internship in the best Hospital in Peru: Edgardo Rebagliati. Subsequently, Chiara was one of 3 candidates selected among 500 applicants to study at Clínica Barraquer, the leading Ophthalmology school in Latin America. She completed additional training in Oculoplastics, Pediatric Ophthalmology and Glaucoma at Columbia University, the IMO in Barcelona, the Stein Eye Institute in UCLA, and Pisan University Hospital Cisanello in Pisa.

Chiara returned to San Martín de Porres to study Gastroenterology and again graduated at the top of her class. She has completed additional training in hepatology, Anorectal Manometry and Esophageal Function testing, Clinical Nutrition and Weight Management, Inflammatory Bowel Disease and Esophageal diseases, and Endoscopic Bariatric Therapies at various universities and hospitals in Chile, Colombia, Brazil, US and Spain such as the Mayo Clinic, Diversatek University, IRCAD, HM Sanchinarro University Hospital, Boston Medical Center, and the Cleveland Clinic.

Chiara later earned a Masters in Clinical Nutrition at Universidad de Barcelona in Spain. She is currently focused on Functional Medicine and is Certified by the Institute of Functional Medicine in USA. From the functional medicine point of view, all diseases begin in the gut microbiome and affects metabolism, weight, hormones, skin, immune system and even mental health.

She leads a private medical practice in Gastroenterology, Nutrition and Functional Medicine.

Mastering this singular combination of medical disciplines affords Chiara an unparalleled perspective from which to treat the root cause of patient symptoms, and unique in the LATAM region. Chiara started a medical blog in her specialty fields, as well as an online program in Pregnancy Nutrition. With time, she became one of the most distinguished Gastroenterologist in Peruvian TV and social media. The approach she uses in medicine, and in life itself is to shape wellness from the inside.

Chiara launched Proteandina, a Peruvian leading company that developed and commercialized a protein shake weight management program with a vision to maintain results by lifestyle changing. Proteandina products contain plant-based gluten-free pseudocereal protein-rich Peruvian superfoods powders from quinua and kiwicha (amaranth), which are substantial sources of essential amino acids and unsaturated fatty acids, as well as high in fiber and rich in vitamins (B, C), minerals (iron, calcium, phosphorus, zinc), polyphenols and antioxidants.

As a CAPAC Venture Partner, Chiara is focused on health sector companies, contributing through sourcing, due diligence and Board representation. She is fluent in Spanish, English and Italian, and proficient in German.

Why us

- Led by experienced operators and financial engineers with exceptional track records and credentials

- Flexibility to invest in a broad range of opportunities

- High level of focus and commitment combined with deep expertise, experience and robust networks

- Global presence Multigenerational perspective

- Fast response and flexibility

- Flexibility to invest across any industry and stage

- Flexibility to extend or shorten holding period

- Flexibility to apply a wide range of financing structures

- Able to operate as insiders in several growth industries

- Deep and broad technology expertise and assets

- Operationally-focused

Providing Superior Financing Options Solutions

Let’s Numbers Talk

"Pulvinar varius velit blandit etiam massa posuere mauris scelerisque ornare nunc sed."

Lorem fistrum

General Manager

Explore opportunities to partner with us

We will contact you as soon as possible to discuss how we can help your business reach its full potential.